Foreign investors investing heavily in industrial parks

Many European giants such as Germany, Denmark, and Asian giants are landing in a series of industrial parks to open long-term factories.

At the end of the first quarter, Fuchs Group, the German oil and viscous giant, announced the expansion of operations in Vietnam by leasing 20,000 m2 of land in Phu My 3 Specialized Industrial Zone (PM3 SIP) in Ba Ria – Vung Tau to build a new plant.

With a 55-year lease, the German manufacturer of viscous oil with more than 90 years of experience shows a long-term commitment in Vietnam. Kazama, deputy director general of PM3 SIP said Fuchs Group is the second European company at PM3 SIP, opening up opportunities to attract the community of other Western investors who want to join the coastal industrial park.

Back in February, the industrial real estate market recorded a factory lease between Framas and KTG Industrial. Framas, Germany’s leading manufacturer of injection presses, has rented a 20,000 m2 ready-built facility at Nhon Trach 2 Industrial Park, Dong Nai Province, a 10-year lease.

On February 17, LOGOS and Manulife Investment Management formed a joint venture to acquire a built-to-suit plant with a total area of 116,000 m2 with an investment value of $80 million.

CapitaLand Development also signed a $1 billion investment memorandum with Bac Giang Province to develop CLD’s first industrial zone, logistics zone and urban area in Vietnam. At the same time, BW Industrial Development Joint Stock Company acquired DEEP C Industrial Park with a size of about 74,000 m2 in Bac Tien Phong Industrial Park, Quang Ninh province.

In the first two months of the year alone, Thai Nguyen attracted $924 million in FDI, accounting for nearly 18.5% of the country’s total FDI in the period. Among them is the $920 million capital addition of Samsung Electro-Mechanics Vietnam Co., Ltd., Samsung Group (South Korea). As a result, the total investment in Yen Binh Industrial Zone in Pho Yen and Thai Nguyen towns increased to 2.27 billion USD (nearly 52 trillion VND).

Also in the first quarter, Denmark is the largest investor in Binh Duong industrial capital with a total investment of $1.3 billion, accounting for 78.9% of the total registered capital. In mid-March, Binh Duong awarded an investment certificate to the Danish LEGO Group in VSIP III industrial park for a project totaling more than $1 billion. This is the 6th largest factory globally and the second in Asia (the first factory built in Jiangsu, China) by Lego.

The heat of the industrial real estate market continued to spread to the second quarter when in early April, HuaLi Group signed an Investment Cooperation Agreement with investors of WHA 1 industrial zone and Hoang Mai I industrial zone.

In Hoang Mai I Industrial Park, the Taiwanese manufacturer built the Factory of Footwear Processing for Export. The project will be started in June and completed in March 2023. When the plant comes into operation, there will be a production of 25 million pairs of products a year, creating jobs for about 16,000 workers.

In WHA 1 – Nghe An Industrial Park, HuaLi Group built a factory on an area of 7.3 hectares with a total investment of 38 million USD. The project will start in August this year and be completed in June 2023. When the plant goes into operation, there will be a production of 13 million pairs of products a year, creating jobs for about 8,000 workers.

The rampant landing of international investors in the industrial real estate market has pushed the price of industrial land rents to continue to rise, despite the rising ground prices that has been quite high over the past 2 years.

JLL’s first quarter 2022 industrial real estate market report shows that industrial land prices maintained strong growth momentum (up 8.5% year-on-year) thanks to a new wave of FDI pouring into Vietnam after the recovery of flights and the opening of international borders. The average rent for industrial land reaches USD 120 per m2 for the lease cycle.

JLL commented that the market of factory building has moved to a larger scale to capture the needs of tenants, especially international visitors who choose to lay the foundation or expand production in Vietnam but want to save time, cost and quickly go into operation.

Savill Vietnam confirmed that Vietnam has attracted a lot of international industrial real estate developers with new projects in the process of construction in early 2022. Besides the factory, another branch of industrial real estate is the data center and warehouses are recording an increase in high-quality investment sources. Many large American and European companies are looking for opportunities to enter the Vietnamese market at the research and in-depth analysis stage to select the appropriate location.

Trang Minh Ha, Chairman of the Board of Directors of North Stars Asia, said that the re-launch of international routes along with signed trade agreements is opening up opportunities to attract huge foreign capital for Vietnam’s industrial real estate in 2022.

Ha analyzed, Vietnam is the second largest country in Asia (only after Singapore) in terms of the number and coverage of the world trade agreements. The total GDP of countries that have signed trade agreements with Vietnam has accounted for 53% of global GDP.

He said, the US-China trade war and North Korean tensions in previous years have formed a trend for South Korea, China to invest in Vietnam in the last 1-2 years. Singapore and its Asian-born investor group ranked first in terms of new registered FDI in the first months of 2022, which could be a channel for Chinese indirect investment in the Vietnamese market.

Vietnam also attracted huge FDI inflows as labor costs were only 60% of Thailand, 31% of Malaysia and 25% of China. Corporate tax in Vietnam is also the lowest in the region at only 20%, accompanied by many tax incentive policies in each province for FDI enterprises. Taxes and labor are not the last advantage because in comparison with the cost of industrial land lease, Vietnam is also very low compared to ASEAN countries.

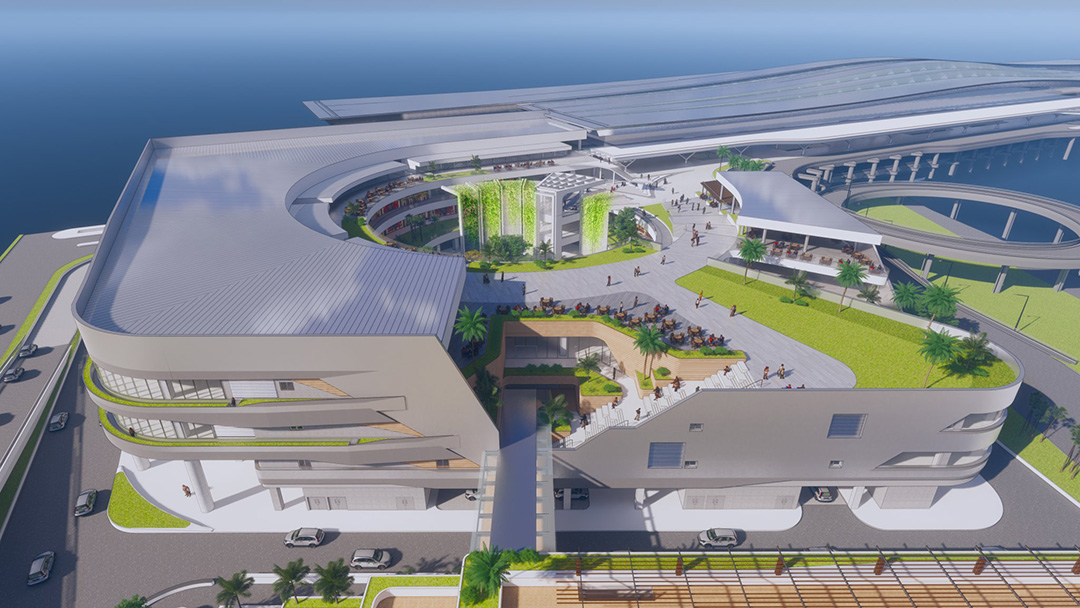

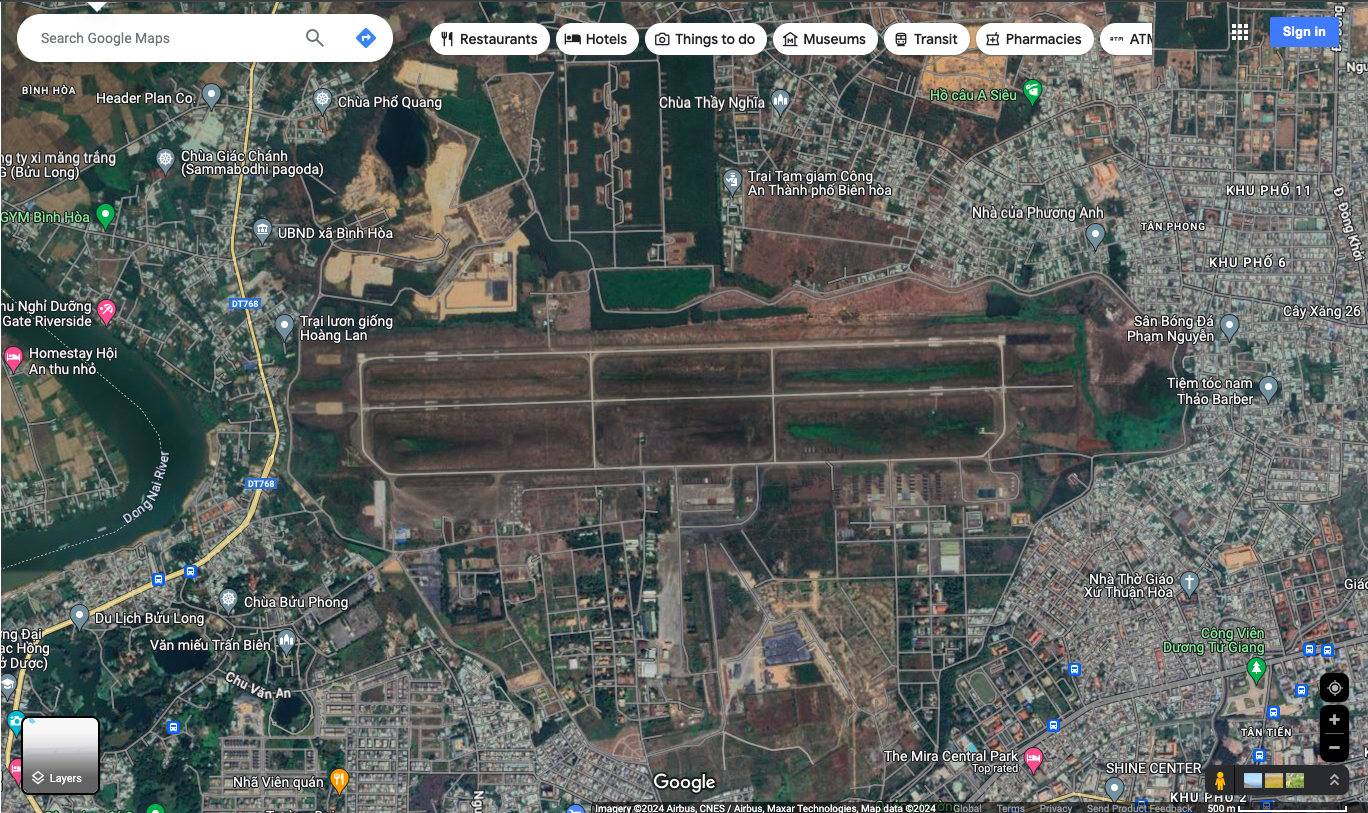

In addition, according to Mr. Ha, the Government’s 350,000 billion support package to boost public investment in North-South expressway projects, Long Thanh airport, etc. will also help improve the logistic cost in Vietnam significantly, thereby increasing the prospects for investment in industrial parks.

According to John Campbell, Head of Savills Industrial Services Vietnam, Vietnam’s economy is forecast to grow positively in 2022 as domestic demand recovers and foreign investment flows maintain steady momentum. In addition, business conditions have improved significantly over the past 5 months following the hurdles of the Covid-19 Delta outbreak in 2021.

John Campbell foresees, along with the resumption of the international flight that draws international investors back, the Government’s active support for foreign investors as well as the resilience and good adaptability of domestic businesses are opening up the promising future of the industrial real estate market in 2022 and the coming years.

Source: VN Express