Demand for data centers attracts global investors to Vietnam

Data center investments in Vietnam are gathering momentum as the country looks toward the digital transformation of its fast-expanding economy and implements regulations on data localization for foreign firms.

Vietnam’s data center market size is expected to increase to more than $1 billion by 2028 from $561 million in 2022, growing at a compound annual growth rate (CAGR) of 10.68%, according to Research and Markets, the world’s top market research store.

In its report, “Vietnam Data Center Market – Investment Analysis & Growth Opportunities 2023-2028”, the firm said existing operators are expanding their presence in the country by investing in new facilities.

The market’s strong growth is being driven by government efforts and initiatives, for example, the Digital Transformation Program 2025 which aims to transfer around 50% of the business to digital platforms.

In August 2022, Amazon Web Services (AWS) announced the launch of its edge data centers in Hanoi and Ho Chi Minh City. AWS joined the ever-largest U.S. business mission to Vietnam from March 21-23, organized by the U.S.-ASEAN Business Council (USABC), to discuss and sound out investment opportunities. AWS and other tech firms in the delegation said they want to help develop Vietnam’s digital economy.

Some current key investors in the Vietnamese data center market are Japan-based NTT Global Data Centers, and Vietnam-based firms Viettel, VNG Corp., HTC Telecom International (ECODC), FTP Telecom, CMC Telecom, VNPT, and VNTT.

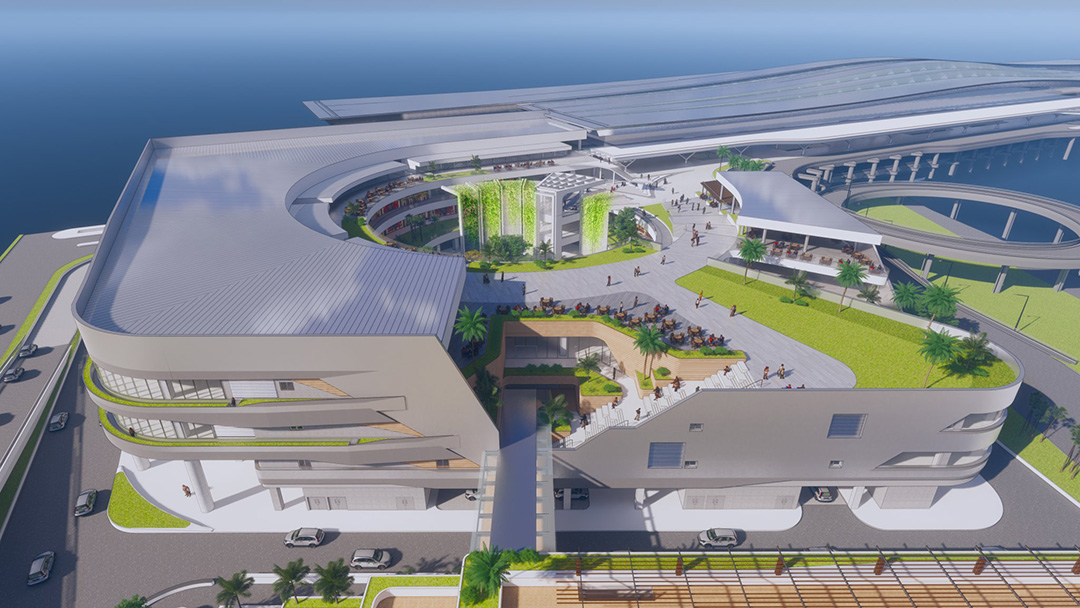

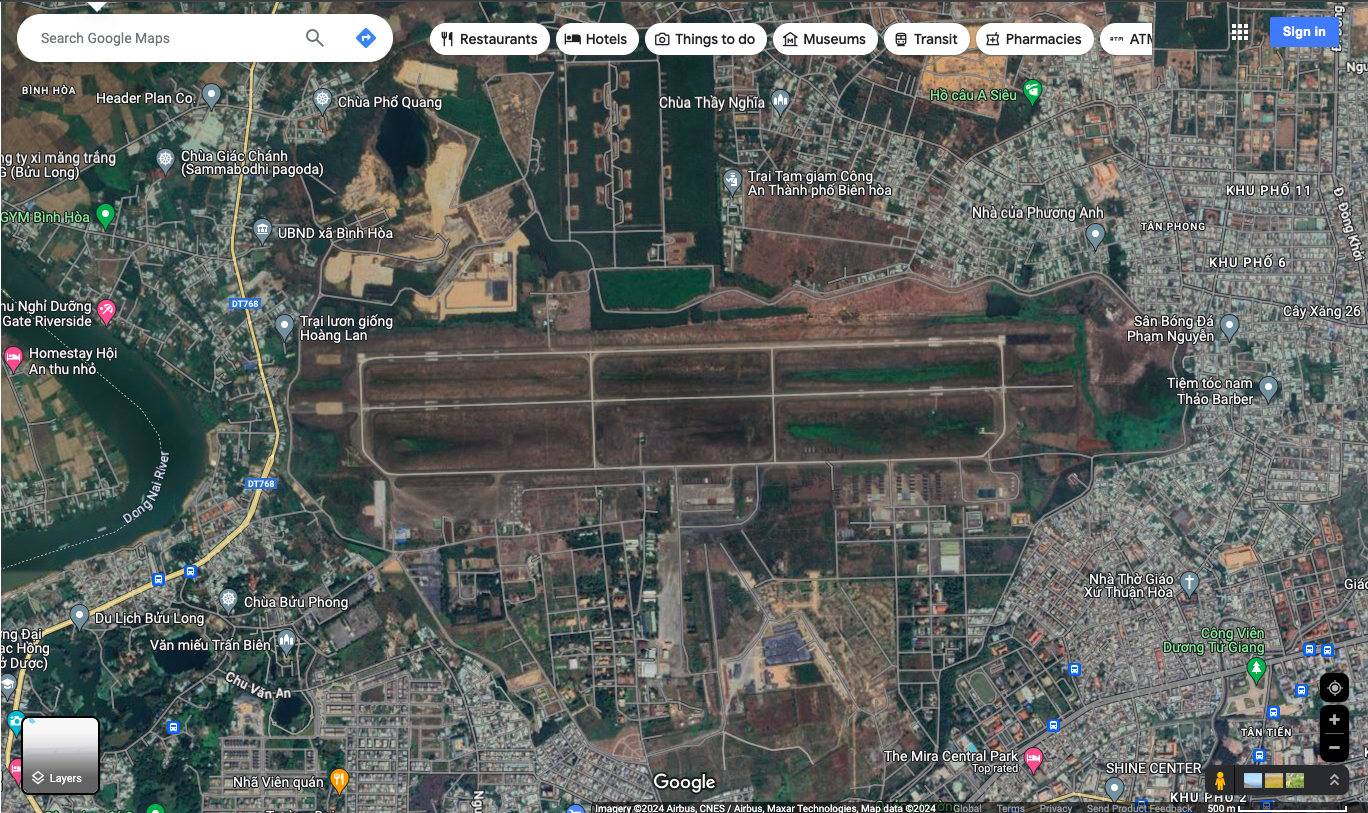

NTT Global Data Centers is building its second data center in Vietnam as a partnership with domestic firm QD.Tek. The facility, called NTT Global Data Centers HCMC1 and located in HCMC’s Saigon Hi-Tech Park, is set to open in 2024. The five-story building will provide a total of 6 MW of IT capacity across 3,100 square meters of server rooms, equivalent to 1,200 racks. The project’s total investment has not been disclosed.

Japan’s NTT Group announced on March 21 that it is investing $90 million via its subsidiary NTT Global Data Centers to build a new data center in Thailand’s Bangkok, and the center will also open next year.

“The economic activity based on the digital infrastructure available in South Asia is changing rapidly. High-quality digital infrastructure is required to support the accelerating digital needs of enterprises,” Takeshi Kimura, managing director of NTT Global Data Centers in Asia, said in the announcement. “We plan to expand further in this area,” he added.

“Asia Pacific is a key growth region for NTT,” Sutas Kongdumrongkiat, NTT Thailand CEO, said in the release.

Southeast Asia’s online economy is forecast to be worth $330 billion in 2025, almost tripling in five years, according to a Google-led study. The region’s internet economy is forecast to reach $1 trillion by 2030, with Vietnam second only to Indonesia, according to the report.

According to U.S. market researcher IDC, Southeast Asia’s cloud infrastructure revenue rose to $2.18 billion in 2022, up 25% over the previous year. While Singapore accounted for around half of the total, Vietnam, Indonesia, the Philippines, and Thailand each posted annual growth of over 30%, outpacing the wider Asia and global markets, which expanded by 25% and 29%, respectively.

Vietnam is seeking to reach carbon neutrality by 2050. Meanwhile, American tech giant Amazon, including its AWS, aims to reach net-zero carbon emissions by 2040. Google has set a goal to power all its cloud data centers with carbon-free energy, 24 hours a day, by 2030.

Singapore’s Keppel Corporation now has plans to expand its business in Vietnam for stronger growth in an alternative manufacturing hub for investors and companies seeking to diversify from China.

The data center sector and clean energy transition in Vietnam are the industrial conglomerate’s new areas in the country beyond real estate, Keppel Corp. CEO Loh Chin Hua told Nikkei Asia earlier this month.

Vietnam’s Ho Chi Minh City is in the top-10 group for selection in the land price category in Cushman & Wakefield’s latest annual report on data center developments published by the global property services firm this February. The report ranked major data center markets around the world based on 13 categories, including market size, fiber connectivity, power cost, and environmental risks to determine the top overall markets as well as the top-performing markets in each category.

Vivek Dahiya, head of Cushman & Wakefield’s data center advisory team, Asia Pacific, said interest and investment in the APAC region would continue at pace as the sector evolved.

“We are seeing significant investment and interest in Bangkok, Ho Chi Minh City, Hyderabad, Johor and Manila and we expect this to continue, along with interest in other primary and secondary markets in the region,” Dahiya said.

Vietnam may be a frontier data center market at this juncture, but has numerous fundamentals that would suggest great potential for development going forward, Cushman & Wakefield said in the report.

Source: theinvestor.vn