Racing to set up a billion-dollar industrial park to welcome “eagles”

In the first months of 2022, in many provinces and cities, there was an explosion of investment waves to establish industrial parks to attract domestic and foreign investors.

The real estate market and the restoration of international flights to Vietnam have brought positive signals to the industrial real estate market in the early year of 2022. To prepare to welcome foreign investors as well as meet the demand for production and business recovery of domestic enterprises, the supply of industrial parks increased significantly.

A series of billion-dollar industrial parks

Specifically, VSIP Group has just started construction of VSIP III Industrial Park at the end of March 2022 on an area of about 1,000 hectares in Hoi Nghia, Tan Uyen and Tan Lap commune, Bac Tan Uyen district (Binh Duong province). This is the third project under the VSIP brand in Binh Duong and the 11th project of VSIP Group in Vietnam.

Up to now, 31 domestic and foreign corporations and companies have been interested in exploring the possibility of production development in VSIP III – Binh Duong, equivalent to 176 hectares of industrial land and $1.8 billion of expected investment capital. Notably, VSIP III is designed to integrate smart technology in operations from energy, water and waste usage to traffic management and security.

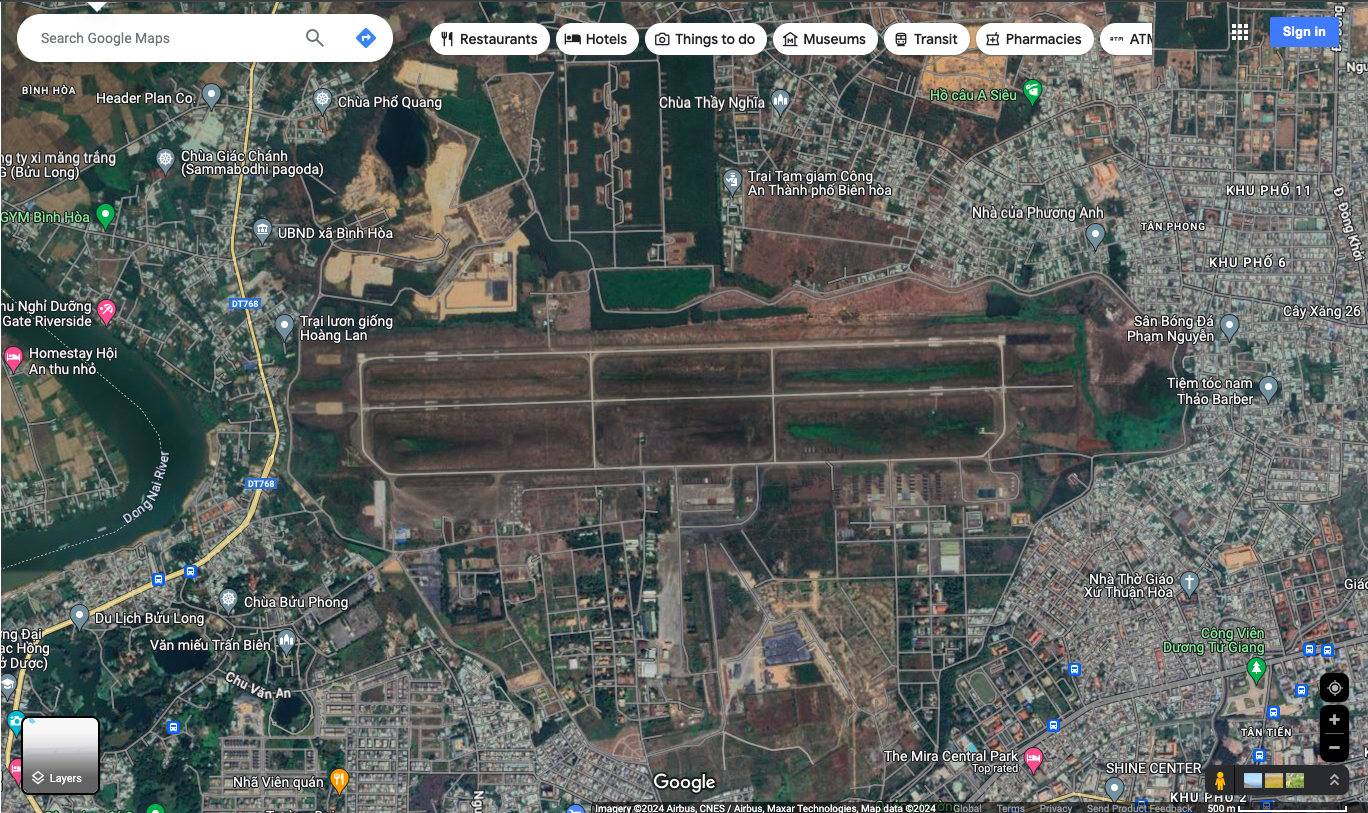

Analysts of SSI Securities Company (SSI Research) said that in 2022, the demand for industrial land rental will still increase sharply due to the shift of production from China to Vietnam. Land rental demand in industrial zones will recover in 2022 when the MOUs signed in 2021 will be completed in 2022. Besides, infrastructure projects such as Bien Hoa – Vung Tau expressway project Ships, Dau Giay – Phan Thiet, North – South expressway, Thi Vai – Cai Mep port, Gemalink port will create convenient traffic connecting industrial zones.

Or recently, Dai An Industrial Park – Urban Development Investment Group Joint Stock Company together with Indian investors have chosen a location to invest in the development of the international pharmaceutical park city project in Hai Duong with a 960 hectares, total investment 10-12 billion USD. The project will be the gathering place for many famous pharmaceutical companies in the world to come here for research and production. Here, the outcome products will serve for export not only in the region but also to fastidious markets such as the US, Japan, Europe…

Saigon Telecommunications Technology Joint Stock Company (Saigontel), a member of Saigon Investment Group, together with VinaCapital and Aurous Company (Singapore), has just signed a memorandum of understanding on investment cooperation in an 700 ha urban industrial complex project in Bac Giang province. The total investment value of the project is expected to reach 2.5 billion USD.

Domestic companies also announced investment in new projects such as Vinhomes Industrial Park Investment Joint Stock Company recently proposed to be the investor to build technical infrastructure for an industrial cluster project in Mong Cai City, Quang Ninh. Phat Dat Real Estate Development Joint Stock Company has established a subsidiary company that is Phat Dat Industrial Park Investment and Development Joint Stock Company with the current charter capital of 3,000 billion VND.

Facing the fear of oversupply of industrial zones when the number of them in many localities increased sharply, Dr. Su Ngoc Khuong, Senior Director of Savills Vietnam, said that he was not worried because the planning of industrial zones had strict plans and regulations. Explaining the increase in the number of new industrial zones, Dr. Khuong said that the cause was the prolonged and pent-up COVID-19 epidemic before opening. In addition, the positive growth of Vietnam’s economy to attract investors has also created conditions for industrial real estate to boom in the first months of 2022.

However, according to Dr. Khuong, in order to attract “eagles” that are multinational corporations, Vietnam not only needs to have large-scale industrial parks but also has to do well on many factors in terms of transport infrastructure and logistics infrastructure such as supply chains, warehousing, seaports, administrative procedures…

“Especially, localities and Vietnamese businesses need to well prepare high-quality, professional and skilled human resources for high-tech industries. Because at present, industrial zones strictly comply with the Government’s policy, which is to give priority to investors in the fields of creating products with high technology and brain content, not choosing labor-intensive fields” – Dr. Khuong said.

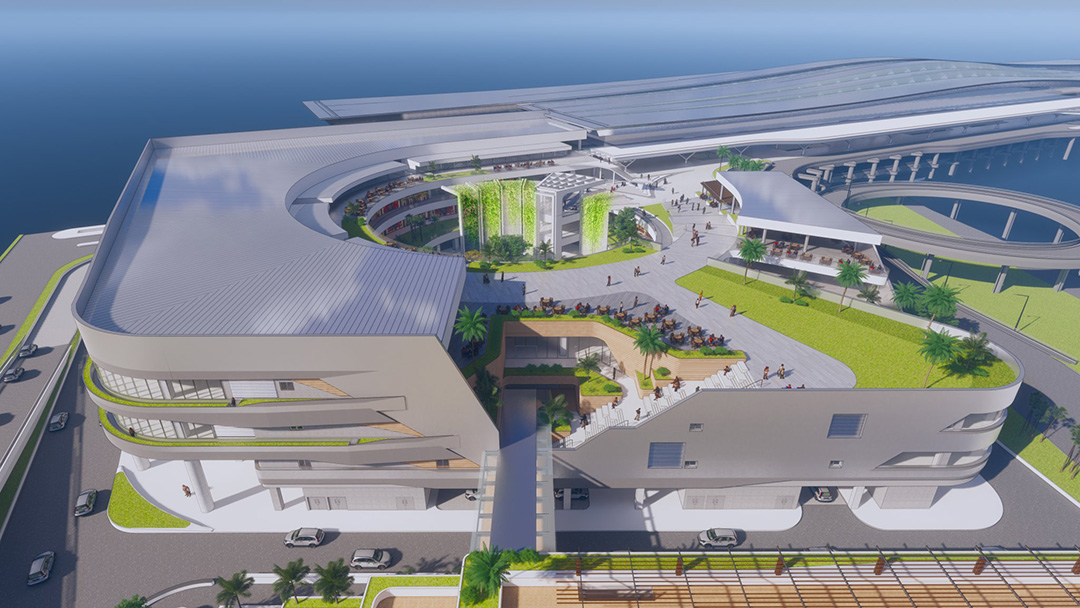

Mr. David Jackson, CEO of Colliers Vietnam, said that Vietnam needs to renew the model of industrial park development in the direction of ecology. This model will play an important role in the sustainable development strategy in general, helping to reduce resource exploitation, limit the impact on the environment while still not affecting the performance of businesses. In addition, this environment will also make a positive contribution to Vietnam’s and global efforts to combat climate change.

Specific steps that can be taken are to improve the technology transfer capacity of enterprises, apply advanced technology and minimize emissions and pilot the conversion in advance of some industrial zones according to the model of eco-industrial parks to derive the most effective way.

According to Mr. David Jackson, industrial zones need to create linkages with each other to develop goods production and logistics chains. Thereby, improving the competitiveness of products, lowering production costs, and improving the sustainability of the whole industry

The rental price of land for industrial zones in Vietnam is lower compared to that one of Thailand and Indonesia

According to SSI Research’s report on industrial real estate in 2022, the price of industrial land in Vietnam is still low compared to other countries in the region, 20%-33% lower than Indonesia and Thailand.

According to Colliers, rents in industrial zones such as Bogor – Sukabumi, Tangerang and Bekasi in Indonesia are 42%-51% higher than in industrial parks in Vietnam such as Binh Duong, Dong Nai, Bac Ninh and Hai Phong.

However, SSI Research estimated industrial land rents in Vietnam to increase by 8%-9% in the South and 6%-7% in the North by 2022. The scarcity of industrial zones in Ho Chi Minh City and Hanoi takes place in the context of the increasing demand for industrial land, factories and warehouses, which is the source of the increase in industrial real estate rental prices.

Source: Ho Chi Minh City Law Newspaper